SAP Global Tax Management

Global Tax Management: An Overview and Key Considerations

What is Global Tax Management

Global tax management is the process by which tax managers evaluate the global taxability of an organization’s industry, corporate structure, business model, operations, products or services, business activities, and daily transactions.

To ensure global tax reporting requirements are met accurately and consistently by all subsidiaries across multiple tax jurisdictions, global tax management requires a holistic view of an organization’s entire flow of transactional data across its entire value chain.

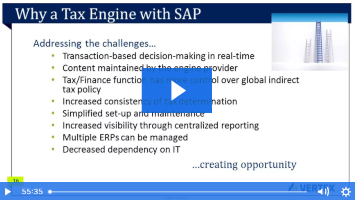

Global tax management brings together disparate technologies from multiple vendors, such as SAP, Vertex, Sovos, Avalara, Thomson Reuters, and different currencies and various regulators, contributing to complexity across the tax function.

Global Tax Management: An Overview and Key Considerations

What is Global Tax Management

Global tax management is the process by which tax managers evaluate the global taxability of an organization’s industry, corporate structure, business model, operations, products or services, business activities, and daily transactions.

To ensure global tax reporting requirements are met accurately and consistently by all subsidiaries across multiple tax jurisdictions, global tax management requires a holistic view of an organization’s entire flow of transactional data across its entire value chain.

Global tax management brings together disparate technologies from multiple vendors, such as SAP, Vertex, Sovos, Avalara, Thomson Reuters, and different currencies and various regulators, contributing to complexity across the tax function.

For many organizations, global tax management typically involves these three steps:

- Define compliance needs worldwide across all operating units, lines of business, tax jurisdictions.

- Map businesss processes to govern how compliance should flow through the organization globally.

- Implement technology solutions that can accurately collect information and content updates from disparate sources in alignment with defined business processes to deliver master data and financial information asynchronously as required.

Key Considerations for SAPinsiders

Understand the growing complexity of global tax management. Organizations considering different areas of the world for new potential opportunities must be aware of how these business interests can affect the local country’s taxation. Changing legislation and mandates around global tax management is becoming ever more complex as organizations face growing challenges in evaluating how their growth initiatives may impact global tax liabilities.

Evaluate your content needs for effective global tax compliance. Tax managers need to consider what global activities may be taxed in which locations and ensure that they are meeting the tax requirements of each country accurately and promptly. Greater global tax compliance efficiency can help organizations reallocate accounting resources to support revenue-generating tax compliance opportunities.

Implement technology to simplify global tax management needs. The Ingram Micro and Dow Chemicals case studies provide best practices outlining how technology makes it possible to create a global view of the enterprise, enabling tax function managers responsible for global compliance, global reporting, and global controls. Content updates that provide real-time data on tax jurisdictions, tax rates, and tax content changes are critical for efficient global tax compliance.