In This Webinar:

Today’s tax compliance landscape has never been more challenging. As global e-commerce transactions continue to grow and organizations integrate digital business activities with their existing operations and ERP systems, the end-to-end indirect tax process is becoming more complex and costly to manage. This complexity increases when supply chains extend across borders, as indirect tax calculation and reporting can vary from one transaction to another. To avoid financial risks, penalties, and supply chain disruptions, organizations must calculate indirect taxes efficiently and accurately. Regulatory updates specific to indirect tax calculation and compliance, such as first-time-right mandates, require organizations to modernize tax functions and replace certain manual processes with indirect tax process automation.

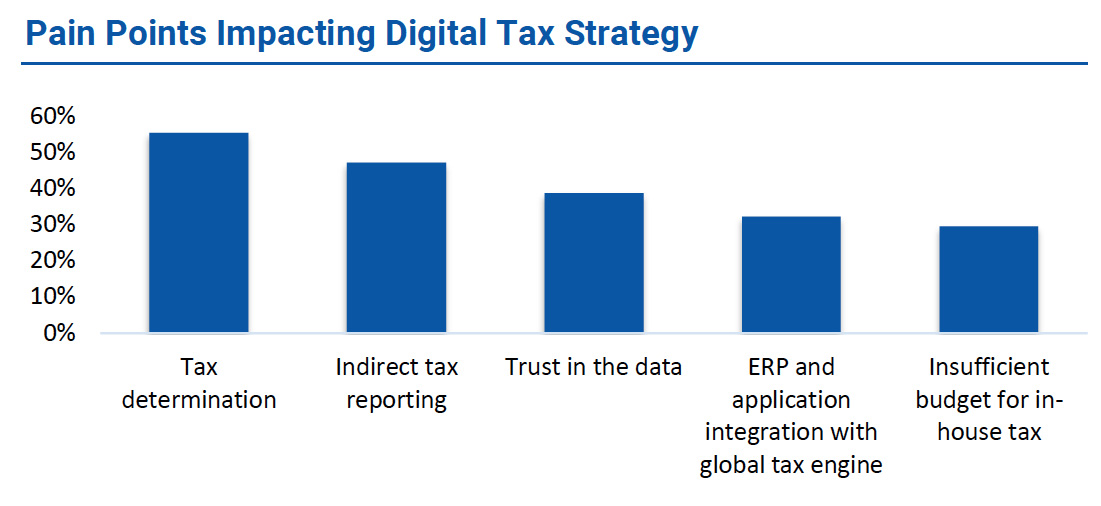

From August 2021 to October 2021, SAPinsider surveyed 119 members of our tax community to understand better the trends impacting respondent organizations’ digital tax strategy. Our data shows tax determination (56%), indirect tax reporting (47%), trust in the data (39%), and ERP application integration with global tax engine (32%) as the top pain points impacting respondent organizations’ digital tax strategy.

Explore related questions

Register to attend the webinar on December 16 at 11am ET to have your questions answered and:

- Learn the challenges that your peers are facing in tax, and how they are successfully overcoming these challenges

- Discover the strategies they are using to optimize tax and automation, and the results they are experiencing

- Understand the latest trends in tax, and what is driving the adoption of tax automation solutions