ICD Joins Kyriba Liquidity Network With Addition Of Real-time Investments

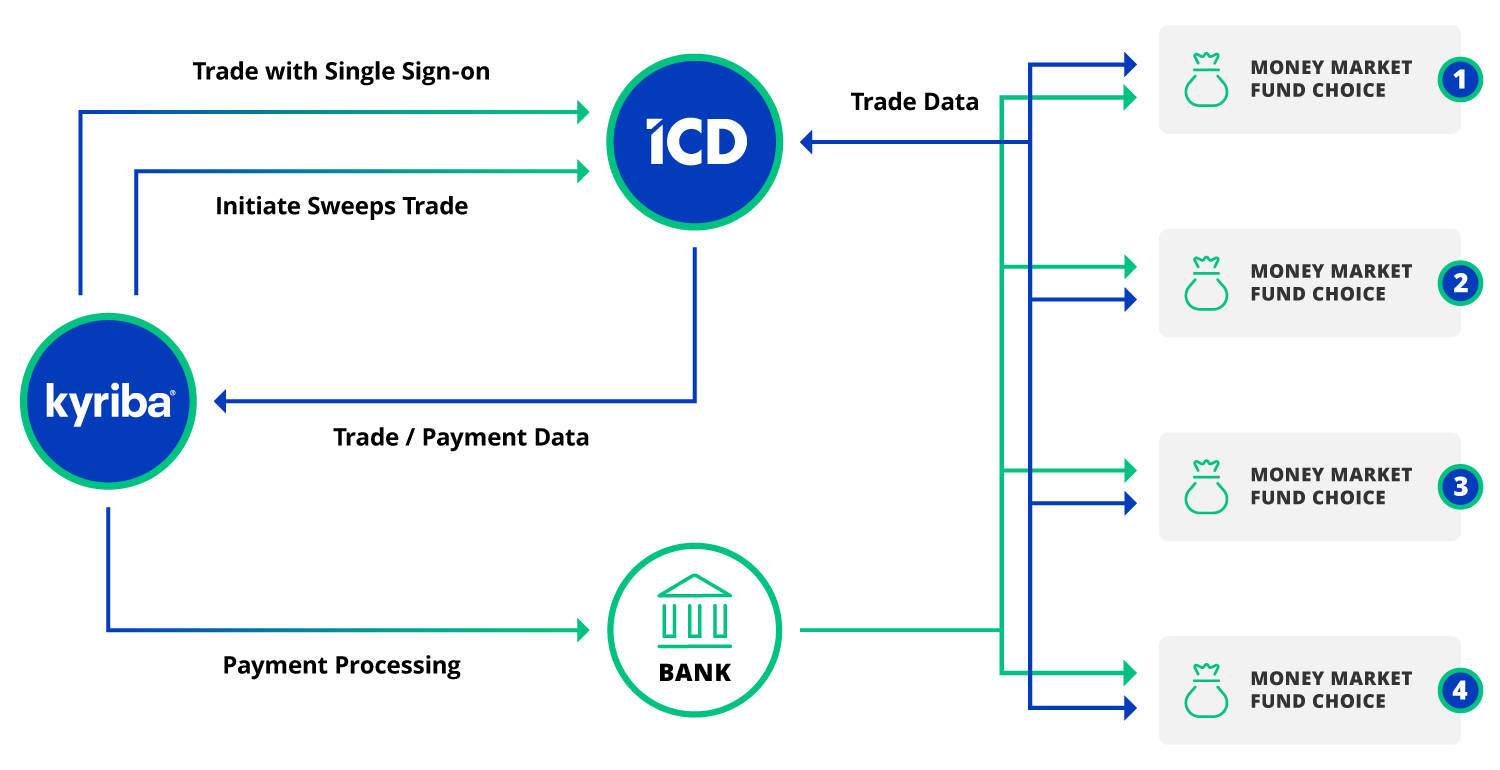

Constantly challenged with new data and reporting requirements to support the business, treasury organizations are turning to modern technologies for greater visibility, accuracy, and speed. By leveraging Kyriba’s API, ICD creates a seamless, end-to-end workflow for clients to gain control over their liquidity management and investment processes.

Key Challenges to Treasury

- Multiple platforms and logins to manage investments

- Lack of unified view of cash positions

- Separate reporting and analysis based on unsynchronized data

- Operational risks from manual trade and payment processes

- Manual processes to fix issues

Benefits of Real-time Treasury

- SSO connectivity from Kyriba’s workflow map as part of treasurer’s day to day

- Enhanced decision making with real time data

- Automated trade settlement to reduce manual processes

- Reduced operational and financial risks through process automation

- Daily automated sweeps to maximize return on surplus cash

ICD is treasury’s trusted, independent portal provider of money market funds and other short-term Investments. Its exceptional service and intuitive technology makes it easy for organizations to access and participate in the money markets.

“Ensuring efficiency, security and streamlined workflows have been the cornerstone of ICD’s commitment to our clients. With single sign-on and deep integration with Kyriba, our joint clients limit risk and add efficiencies to their cash and liquidity management processes.”

Explore related questions

SEBASTIAN RAMOSEVP, Global Trading and Products, ICD