RISE with SAP: Innovation and Hyperscalers

Webinar On-Demand

Meet the Experts

Key Takeaways

⇨ Lean about the factors impacting a RISE with SAP decision

⇨ Understand how RISE with SAP is building a platform for innovation

⇨ See the role hyperscalers are playing with RISE with SAP

Robert Holland (00:01):

Right. Hello and welcome to today’s webinar, rise with s a P, innovation and Hyperscalers, hosted by SAP Insider and presented by Amazon Web Services. I’m Robert Holland from SAP Insider. Uh, just a couple of announcements before we begin. Uh, for the presentation, I will answer as many questions as time permits. Uh, please submit your questions using the q and a panel open, uh, which you can open at the bottom of the Zoom window. Um, you’ll also be able to download a copy of today’s presentation, uh, via an email that you will receive after the session. So, um, that’s how you’ll be able to get access to the presentation and also a recording so you can, uh, watch the session on demand. So onto the report. Um, so I approached this, at least if you’ve read the report a little bit differently than some s insider research, because we actually focused a little more on some of the topics around, um, hyperscalers.

(01:09):

Uh, while we did have our dart, uh, as part of the, um, as part of the written report, it wasn’t necessarily the focus of it. Um, part of the reason for that is that, uh, we sort of focused more on that in a second rise with s a p report that was published, um, at the end of November, which will focus more on engagement as well as the, uh, the DART portion of it. Um, the way this presentation is structured, it, it is pretty standard in terms of I will go through the dart. Um, so hopefully that won’t be, you know, duplicated, uh, with anything. But, uh, I will sort of spend a bit of time on the, on the questions at the beginning, um, to ensure that, uh, um, to ensure that you have a full understanding of the way people responded to the survey, um, excuse me, uh, particularly when it comes to what they’re thinking around engagement with hyperscalers and how that’s sort of impacting their, uh, likelihood for adopting Rise with SAP, um, or their potential for, uh, or whether they are engaging in rise with s a P.

(02:22):

So, we did focus on members I of it, uh, and those, uh, you know, involved with E R P and their cloud environments or organizations that are part of our community, and we sort of surveyed them about their plans for Rise with s a P. The goal really, as I said, was to sort of determine what their existing E r P environment looks like, um, whether they were a potentially considering rise with sap and you know, what their relationship was, um, with Hyperscalers. Um, so we conducted this, this research in August and September of 2022. Uh, published the report at the end of oc, sorry, August and No, between August and October, and published the report at the end of October. Uh, there were 152 members of our community that completed the survey. Um, I did talk with a number of them. Uh, and, you know, that sort of does make it into, um, into the, into the, the, the quotes that you potentially see on the side of the published written report.

(03:28):

Um, respondents were split pretty well, typically for what we sort of see with s a P Insider research, um, with 43% coming from North America, 39% from amea, uh, 14% from a PJ and, and 5% from Latin America. Um, you know, and that sort of generally follows the breakdown of SAPs, uh, the size of the markets, uh, for sap, although, um, a P J is growing significantly for, um, for SAP now, um, particularly with the, the focus that Scott Russell has brought to that being from that region. Um, in terms of where respondents sort of sat in their organizations, um, we, we didn’t really, I sort of did a similar breakdown to, you know, what I did last year. Um, other research that I’ve sort of done recently sort of broke it down more into, um, you know, whether they were in things like the s a P team, et cetera.

(04:32):

Um, primarily the largest respondent group was in it. Um, but we also had respondents from hr, finance, business development, uh, manufacturing. Uh, beyond that, there were some people from customer experience, product development, supply chain, uh, G R C, risk and compliance marketing in strategy research and development, or procurement, procurement, purchasing and, and spend management. That was the smallest respondent group. But all of the ones below, or that I, I mentioned after manufacturing had less than 5% of the made up, less than 5% of the survey respondents in terms of the industries that they came from, um, uh, the largest respondent group was the industrial sector. Um, so that, that makes up manufacturing, agriculture, uh, energy and natural resources. We tend to break it down this way simply so that we get some larger respondent groups. So if we do want to sort of do data comparisons between respondents from different, um, uh, market sectors, then we potentially have a, a, a significant enough pool of respondents that we can, uh, write that, uh, and have that as relevant data as, as against more anecdotal data, which would be if it was less than a, a set of 25 respondents.

(05:58):

Um, but as you can see, respondents came from a, a, a pretty much every different ma like major market sector, uh, even below fi um, yeah, with, um, software and high high tech, which obviously includes, um, people, you know, working for potentially, um, implement implementers or other, uh, vendors, public sector, retail, um, media and entertainment, financial services, hospitality, uh, and healthcare and life sciences. Um, the size of the organizations is something that we, we did ask, we did sort of try to get some insight into, uh, the, how big the respondent’s organizations were. Um, I mean, as you can see, 13% did report that they, they did not know how, how their, their company’s revenue, um, over the last year was. Um, but the way that this sort of split is about almost half the respondents, 49% said that they were from organizations with annuals annual revenues, less than 2 billion.

(07:10):

Um, and that’s pretty much how s a P categorizes, uh, small and medium enterprise. Um, if you, if you sort of look at how SAP breaks down, um, anything up with revenue up to 2 billion is considered small, medium enterprise. And anything with revenue above 2 billion is considered large enterprise. Um, and that was 38% of the respondents. And then of course, you have the 13% who did not identify, uh, their company’s annual revenue. And this is, and that’s an in, and, and that’s relevant at least not that 13%, but the size of the organization is relevant for some of the points that we’re going to talk about. Now. The first question we asked is, what e r P system is your organization currently running today? Um, not really surprisingly, um, the largest respondent group, um, is said they’re running either S A P E C C or s a P Business Suite.

(08:12):

Um, when we run our S A P is for HANA research, uh, in sort of earlier in the year, you know, I’ve still seen maybe as many as 60%, a little over 60% running S A P E C or s a P Business Suite. So this sort of tracks relatively well, um, with those numbers. Um, about 38% say they’re running S A P SRA hana. I think given that this is a rise with s a P research report, we did see a slightly higher, um, number of respondents than we would typically see, uh, reporting that they were running SEP s for hana, because, um, organizations perhaps who aren’t engaged with, uh, s SEPs for hana, uh, may not be looking at rise, but s a p at this point, and that’s why, um, that’s why we’re seeing a slightly larger number of respondents. Um, typically when we do our S for HANA research, um, we, we’ve sort of, we’ve only been seeing high th high twenties in terms of percentages of the number of people who are, uh, currently running S A P S for hana, uh, with maybe another 15 to 18% who are in the process of implementing.

(09:25):

Um, so, you know, I think, I think that sort of is one reason why we did see a slightly higher proportion of respondents who are, who sort of say they’re running either SAPs for hana, SAP s rahan Cloud, um, SAP S for HANA Cloud via Rise with s a p. Um, we do see a, you know, relatively small group, 12% saying they’re not yet running an S A P E R P system. They’re obviously still s a P customers because they’re part of our community. Um, but they may not necessarily be running, uh, an S A P E R P system. That’s may be something that they’re considering. Um, or, and we saw 10% running, either 10% of the respondents said they were running either s a P business, one or s a p business by design. Um, some, uh, e r P systems that are sort of aimed at more, uh, smaller, smaller medium enterprise customers for sap.

(10:23):

Um, now where these organizations fall in terms of their engagement with hyperscalers is we ask the question, in what capacity is your organization engaging with hyperscalers or cloud services today? Um, now this is outside s a p, this is not necessarily related to what they’re doing with S A P. And this sort of really, um, helped us sort of get a bit of a picture of where the respondents, what the respondents are, um, you know, in their, in their path to the cloud and their journey to the cloud, and how that potentially might impact their move to rise with s a P. Um, so we saw that, you know, nearly 50% say they’re doing some sort of website hosting. And, and if you look at the, the different, um, answer choices here, this does kind of represent a path or a, a deeper engagement with a hyperscaler.

(11:34):

So going from website hosting to something like using machine learning or hosting enterprise workloads sort of largely does, um, you know, uh, uh, reflect a deeper engagement. So not really surprisingly, um, only, uh, 36% say they’re using machine learning. 39% say they’re using enterprise hosting enterprise workloads, but at this sort of does represent that graduation of engagement. Um, data lakes and analytics, uh, I think are another major factor. Another ma another major area where organizations do tend to leverage, uh, hyperscalers or public cloud providers, um, because it’s, excuse me, it does allow them to potentially, um, get insight on a greater volume of data than they might potentially be able to do with on-premise systems, or maybe bring data together from other data sources, uh, for example, trend data, weather data, um, that they might not have within their environment, and have that sort of, or correlate that with the data that they’re bringing to the cloud environment from their, uh, other, from their other systems. So I think it makes a lot of sense that there is a significant amount of engagement across some of these different types of, uh, ways that organizations can work with Hyperscalers. Um, but obviously, uh, there’s still 14% of the respondents who said that they’re not currently using hyperscalers, um, within their organization.

(13:17):

Um, the next question sort of reflects on whether organizations are running any s a P workloads on a hyperscaler or cloud services provider. Um, so, and that’s sort of split down the middle, um, about half say yes. And, and nearly, you know, the other half say no, they’re not running s a p workloads on a hyperscaler or, um, cloud services provider. Now, this is interesting because when I sort of filtered, um, filtered the, the responses by whether or not, um, the organization was running any s a P workloads on a hyperscaler cloud service provider, those who were running s a P workloads on a in the cloud were significantly more likely to be interested in, um, rise with S A P than those who were not. Um, and I think that kind of makes sense. I mean, although S A P sort of defines rise with s a P as the journey to the cloud, it, it sort of helps you get to the cloud.

(14:28):

Um, certainly for organizations that are not there, it’s, they’re hoping that Rise with s A P will provide that, um, provide that path, you know, to get a Clouder p system to start using cloud services like the business technology platform. Um, you know, so it will help organizations reach that cloud destination. Um, but, uh, not everyone is necessarily doing that. Not everyone is necessarily running s a p workloads in the cloud. And, and that’s what this, uh, this sort of, uh, reflects now in terms of which hyperscalers, um, or public cloud survi, uh, public cloud providers organizations are leveraging. And this does not necessarily correlate with, with s a p workloads specifically. So it could be looking at, um, nons a p workloads here for, um, you know, for the, for using public cloud providers. Um, not terribly surprisingly, uh, the largest vendor that organizations are likely to be using, um, within their organization is Microsoft Azure.

(15:41):

Um, certainly for s a P workloads, that is the, um, the public cloud provider that we see most organizations, uh, engaging with, particularly around s SAP S for hana. Um, other s SAP workloads may not necessarily be more likely to run on Azure than other platforms, but anyone using s a s for hana, um, we’ve sort of seen that in the, over the last couple of years that organizations may be twice as likely to be using as a, uh, Microsoft Azure for their is for HANA workloads as other cloud providers. Um, but not too far, too far behind is aws. Um, Google Cloud is, is also in the mix. Um, S A P HANA Enterprise Cloud, uh, is also in use by nearly a quarter of respondents. Um, I think a lot of organizations did have used heck, uh, as a means to sort of starting to move their s a P workloads into the cloud, particularly because s a P does provide a, um, a platform as a service environment that’s tailored for s a p workload workloads through Hick. So there’s, there’s certainly, um, you know, it certainly makes sense that organizations are, are leveraging that for, for the cloud workloads, not necessarily, um, for all of their workloads. Um, yeah, we also see Azure, I think, is a more popular provider in Europe. Um, I know that from speaking with different, uh, implementation partners such as some of the big, uh, global solution service partners that s a P uses, they in, in Europe particularly, there’s a much higher engagement with Microsoft Azure than with other vendors. And that’s sort of maybe reflecting part of this here.

(17:39):

So, moving on, um, we asked the question, are you considering a move to rise with s a P? Um, I know from speaking with some customers, SAP has been very aggressive in pushing rise with sap, um, to customers. Uh, even those that are, for example, already running sap, esra, ahan, um, you know, for example, uh, one of the customers, I, excuse me, um, one of the customers I spoke with, uh, said that, you know, they’re, if they’re running S A P S for HANA on an infrastructure as a service environment, um, hosted by a public cloud provider, um, and s a has been extremely aggressive in, you know, asking them to consider moving to Rise with s a p over the last year. Um, you know, it’s not something that they had intended to do, but, um, you know, the, the organization that is administering, um, their infrastructure as a service backend is, um, no longer gonna be supporting the, the, the vendor they’re using.

(18:40):

And so it is an opportunity for them to sort of reevaluate. But, uh, they’ve been under a lot of pressure, and I’m sure that most s a p customers who are running enterprise e r P systems have been under a lot of pressure to consider moving to rise with s a p, excuse me. But what we see here is that, um, a little less than 40%, uh, say that yes, they are considering a move to rise with S A p, uh, a little over a quarter a, a definitive no, um, we’re not going to consider it. Um, and about a third little more are saying, I don’t know. Um, and I think that’s what we see a lot of the time with responses to questions around, around wise at S A P, is that organizations simply don’t know, um, you know, whether or not it, they’re, they’re gonna, they’re gonna move that way.

(19:32):

They’re not sure if it’s an option, a good fit for them, they’re not sure if it’s an option for them. Um, you know, it, it certainly can be a little bit challenging, a little bit challenging for particularly larger organizations. And I think that, you know, if we sort of compare this data and look at, you know, organizations that had revenues below 2 billion, uh, so smaller medium enterprise with those who had revenues above 2 billion, there’s a significant difference in, um, whether those organizations are likely to be considering a move to rise that S a p, um, for example, you can see that more than 50% of those with revenues below 2 billion say they, they are considering a move to rise with S A P, whereas, um, only just over a quarter of those with revenues above 2 billion say that yes, that is the case, um, relatively close in terms of no, although larger organizations are more likely to say they’re not planning a move to rise with S A P, but the big difference here is that those larger organizations are twice as likely to say they just don’t know.

(20:46):

Um, some of that obviously has to do with the size of their S A P database, uh, you know, the number of, um, the number of years potentially that they have data in those database, in those systems. I mean, there are s a p customers that have been running E C C since, you know, since it was first released in the early two thousands, what was it, 2004, 2005, um, when E C C was first released, um, you know, in which itself was an iteration on, um, you know, uh, R three. Um, and then, so it’s, it’s, you know, there are organizations with up to 20 years of data in their enterprise E R P systems, and it’s a significant challenge for them to consider a move to rise with S A P. And I think that’s why so many respondents are, um, saying that they simply don’t know, um, at the moment, whether, whether that’s an option for them, particularly from large enterprise.

(21:50):

But it was also interesting, um, in SAP’s last earnings call. I think there was actually a confirmation from Scott Russell because he was answering a question from one of the financial analysts about the types of organizations that were adopting rice, but sap, and he did actually admit for the first time that, um, even on SAPs records, uh, you know, there was a, um, small, medium, small and medium enterprises made up the majority of those who had adopted Rise with s a p to date in terms of the timeline for moving to Rise with s a P, you know, so of those who were potentially interested in moving to Ryans with s a p, we ask them what might their timeline be. Um, some of them are moving in the next six months, um, but the majority are outside that they’re at least, you know, six to 12 months out, that’s 25%.

(22:51):

Another 25% are 12 to 24 months out, and a third are more than 24 months out. And, you know, I, I know that, um, while there are certainly customers who have already gone production on Rise with s a p, um, the many, some of the customers that I’ve spoken with, uh, who were very early in the adoption process to, to rise with a p uh, I wrote an article on a, after I talked with, um, Zespri International, uh, a month or so ago, um, you know, they’re based in New Zealand. They had a 10 year old E C C system, um, that they were moving to S A P, they wanted to move to S A P S for hana. Uh, they sort of did a cost evaluation, um, made the choice to move to Rise with s a P cause they figured it can save the money over five years.

(23:42):

Um, but I mean, it’s, it’s been, it was a two year, almost a two year long implementation cycle for them. Um, and that’s only the first phase of their, of their journey to, um, you know, rise with s a P. But when you purchase a RISE with s a P, or you commit to using Rise with s a p, um, you know, there are a number of timelines you have to set at the beginning of that process. The first is you have to specify when you’re gonna cut over the S A P S for hana. Um, and you have to keep to those dates, um, or they’re maybe financial implications, you know, if you’re not able to, um, you know, if you’re not able to meet those dates that are specified. Uh, and that’s, you know, beyond, you know, choosing, uh, having a, you know, just choosing a, a hosting partner, choosing an implementation partner, um, you know, et cetera, et cetera.

(24:36):

So there’s, there’s a, a number of things you do have to commit to when you, when you sort of sign that, um, you know, statement of work with S A S A P to, to, to, to move to RISE with s A P. Um, and I think that, you know, with the timeline being at least a couple of years out, I think people, many people are still sort of waiting to sort of see what happens. Um, you know, s a P changed its messaging this year to sort of focus more on, um, the journey to the cloud and being a driver for innovation. Um, whereas previously it was, uh, in, in the first year in 2021, it was much more of a focus on business transformation as a service. Um, and although business transformation is still a major part of the rise messaging, s a P isn’t really using that terminology anymore when it comes to business transformation service. The focus is on a solution for innovation. Um, and that sort of plays into the timeline for organizations making changes as well.

(25:40):

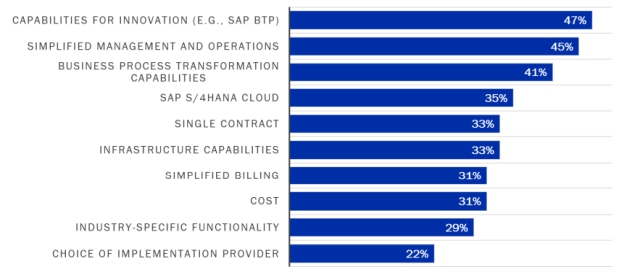

In terms of, um, you know, what are the factors that most impacted your decision to use Rise with s a P? So we only asked the respondents, uh, this question who were considering a move to rise with s a p. So we, we didn’t ask those who were not considering a move. So this is a, a smaller respondent group than the entire survey. Um, so, you know, pretty much the, um, well, well, the, the top factor impacting a decision to use Rise with s a p, and I guess this is beyond S A P S for HA Cloud, because S A P S for HANA Cloud is the, is the sort of centerpiece of RISE with s A p I mean, people are very familiar with that, familiar with what’s there. Uh, although it, it is here on the list, um, but you can’t move to Ryan’s with s a P without making a decision around when you’re going to implement S A P S for AHAN Cloud.

(26:36):

Um, but I mean, the capabilities for innovation, for example, um, A P B T P, um, you know, which you get, uh, consumption credits for with, uh, RISE with S A P I is sort of was interestingly for those who said that they were considering a move. The, the top factor, um, simplified management and operations, obviously, when you adopt Rise for sap, it’s a software as a service application. Certainly, SAP S for HANA Cloud is you’re not necessarily needing to manage infrastructure. You’re not needing to manage patching at a software level. You’re not necessarily needing to manage a number of other things, uh, related to your environment. Um, there are still things that you have to do potentially related to, um, S A P business technology platform if you’re leveraging that or the business network, but it does potentially alleviate a lot of the manage or simplify a lot of your management and operations.

(27:36):

Um, the business process transformation capabilities, um, obviously that’s S A P, the S A P Psig NAVO solutions that are part of Ryans, but s a p, um, they are somewhat, they are somewhat limited, a bit like the S A P B T P consumption credits. Um, you only either have a limited number of users with them or a limited, uh, data store, but it does give you the capability to sort of run an analysis on your existing system, existing E r P system, see what processes are being used, what can be updated, what can be transformed, and give you the starting point to complete that transformation. Um, a little less important for organizations or those interests considering a move to rise with s A P where SAPs for HA cloud itself, obviously, I said it’s sort of inherent to moving with Rise to Rise with sap.

(28:30):

You can’t move to RISE without adopting SAP S for HA Cloud the single contract. Uh, I thinks a P was envisaging with the announcement of Rise with a, that this would sort of be a very big deciding factor. Um, organizations would want a, to coin a better phrase, single throat to choke. Um, when it sort of comes to, uh, you know, comes to the sys, comes to the implementation, you’ve got your hosting included, you’ve got your implementation included, you’ve got your E R P included, you’ve got all these pieces included in the bundle. Um, but, uh, but about, while it is important, uh, only about a third of respondents are selecting that, um, I know many of those who are init, you know, moving to Rise with a a p are starting off with the INF infrastructure capabilities that are there. So they might be lifting and shifting, uh, an existing s a P system to the infrastructure capabilities and rise before the transformation to SAPs for HA Cloud, um, billing cost, uh, the industry specific functionality. And then at the bottom is that the choice of implementation partner. I think that many organizations feel they can, they already can choose their implementation partner, you know, when they’re doing an SAPs for HANA implementation. And that’s sort of, uh, um, maybe that’s why that’s at the bottom of the list.

(29:58):

Now, um, once an organization decides, um, to move to, um, rise with a p, we sort of asked them, you know, what S A P S for ahan Cloud deployment model are you most likely to use? Um, so when Rise with SAP was first announced, I think that only s a P S for Cloud Public Edition was available. Now that is the purest software as a service version of SAP S for HA Cloud running in, uh, a multi-tenant environment. So this is an environment where there’s one copy of the software that multiple organizations are potentially using. Um, may not necessarily be, it just depends on, you know, the way that the system ends up being configured, but there’s one, one version of the software, and you have multiple organizations potentially leveraging that in a multi-tenant environment. Now, S A P S for HA Cloud Private edition on the other hand, is different because, um, each organization gets their own infrastructure set up.

(31:12):

They get their own copy of the software, um, you know, their environment is separated, so it’s a single tenant environment within the cloud. Um, now as you can see, 76% of respondents say that’s the version of S A P S for hundred Cloud that they’re considering implementing when they move to Rise with S A P. Um, there are probably a number of reasons for this. Uh, the first is that you can choose your S A P S for hundred deployment model. If you’re running a p s for HA cloud public edition, really the only deployment model that is open to you is a new implementation. Um, you know, you can potentially bring across some of your configuration, but you’re largely because you’re going into the multitenant public cloud, you’re, you’re starting from a new implementation. However, if you’re going to s SAPs for a hundred cloud private edition, that gives you the option to either do a new implementation, a system conversion, or a selective data transition, which is sort of in between those two.

(32:16):

Now, there probably is a cost differential. Um, you know, if you’re to ensure that you have your own hardware, you have your own instance of the software, um, you know, your, your data is obviously separated regardless of the version that you’re implementing. Um, but everything that you are running is on a sort of unique single tenant environment. Um, you know, that is something that, that does make a significant difference. Um, that might be, and that might have a price differential as well. I’m not, I don’t know off the top of my head what the, the cost is. The cost difference is between going with public edition and private addition, but I think it sort of speaks a lot to what organization, what the majority of those who are considering a move to rise with s a P are interested in implementing, um, in terms of which cloud service provider they’re currently considering, uh, as their first choice.

(33:18):

Um, now this is somewhat anecdotal because it’s only a relatively small proportion of the respondents. So this is those who sort of said, yes, they’re, they’re really planning to implement, they’re planning to implement Rise with s a P. Um, so I think it sort of drops below the 25 total respondents. I include this more as sort of as, as an information point, um, just to sort of give a bit of an idea of, um, where people are considering. Not really surprisingly, Azure is at the top of the list. Uh, s a p has a very close relationship with Microsoft. Um, and so, you know, there’s, uh, so many organizations who are considering a move to Rise with s A P are likely to be considering that a w s Google Cloud i b M Cloud, and then certain proportion is undecided. Um, also the factors, uh, what is interesting is the factors that are potentially impacting that choice as a cloud provider.

(34:20):

You know, once again, it is a relatively small group of respondents, uh, below 25 who answered this question, um, because it’s only those who are saying they’re, they are moving to rise with s a p. Um, but the number one, you know, factor for respondents, uh, was the performance of their provider. Um, ease of migration, cost, access to innovative services, um, less important was a, an existing relationship. Um, you know, like I said, this is, because this is such a small number, I think in, uh, in the report that we published in November, we had a, a larger of num larger number of respondents answer this question. So it’s a little, the data is a little less anecdotal, uh, although, um, the, the, the order isn’t necessarily hugely different.

(35:15):

So, um, I dunno that this slide is accurate. Um, I need to update that slide. I apologize. It’s from a previous report. Um, this line, this is, I think from different report as well. So I will update these when, uh, for the version that is sent out to, to everyone. Um, so moving on to, um, the DART methodology. Um, this sort of gives us a little bit of a background on, um, you know, what people are sort of thinking. The DART that we used was really focused around E R P and innovation. I mean, in the written report, I, I focused a lot more on the hyperscale engagement and sort of worked the DART into that rather than having a, a separate couple of chapters focusing on dart. Um, but I do sort of want to talk through some of these, um, you know, some of these points, um, having updated systems and processes by, you know, um, having the business demanding updated systems and processes that better fit current needs and regular regulatory requirements.

(36:33):

I mean, this, I think really all of these, um, drivers because they’re the drivers for E R P and innovation, and then, and this is where S A P is positioning rise with s a p, it’s cloud e r p, it’s your journey to the cloud. It’s a platform for innovation. Um, and all of these things are sort of necessary to make that happen. Um, I mean, updating your underlying system is a key part of moving to S A P S for HANA generally. And, and particularly obviously, SAP S for HANA Cloud with Rise with s a p, um, I think anyone who’s not on SAP P s for HANA yet is, is well aware of the upcoming end of mainstream maintenance for core business suite applications at the end of 2027. Um, and for those staying in the E S A P ecosystem, that really means you’ve gotta move to S A P S for hana.

(37:26):

Um, and a P would like that to be a p s for HANA Cloud as part of Ryans with a P. But I mean, the capabilities for innovation, um, uh, as sort of the most important factor for organizations that are planning to implement RISE with s a p, it sort of goes beyond simply S A P S for a hundred cloud, right? It’s more than just about updated systems. It’s processes that benefit current needs. Um, so for organizations that have an existing E R P system, um, that frequently involves a significant amount of customized processes, custom code, you’re, you’re well aware that, you know, this has been, you know, writing up up, um, you know, BPIs customizations, you know, it’s one of the major ways that es that customers have, have tailored their E R P systems or any of their s SAP systems to fit the way that their company works.

(38:26):

And it’s been one of the biggest benefits of having an s a P system is the ability to do that customization. But having that customization has also made moving to a new system complex and expensive. Um, customers that I’ve spoken with, um, talked about how difficult it has been to upgrade even to a new, um, enhancement pack for S A P E C C since the cost involved in doing so wasn’t necessarily that different from implementing a new E R P system. So, what s a P has done with remsberg, S A P is that they’ve sort of intro positioned it as a way to introduce new business models and approve of improve EF efficiency in your business processes, right? And that, those process transformation capabilities, um, which is the third most, you know, important factor behind the decision to use Rise with sap, as we discussed previously, they’re provided through S sap, psig, navo.

(39:25):

So there are a few tools that s SAP P provides, um, as part of RISE with sap, there’s cig navo, process managers, cig navo, collaboration Hub, S A P, process Insights, and a one-time process discovery report, um, with Rise with s a P that allow the, goes through your existing environment and does a process discovery to sort of look at what’s there. Um, but I mean, they’re, while they’re important, I think they’re one of the components that also, one of the components that I think respondents are least familiar with. Um, only you 29% of respondents that they had either a moderate or expert level of knowledge about the business process transformation tools within Ryans for sap. But if they’re gonna provide a platform that is a foundation for innovation, you’re gonna need to spend time understanding how your systems work, how they can update your, how you can update your processes to better meet your needs.

(40:28):

Um, obviously, um, you know, beyond that, um, having, uh, modernizing mission critical systems without disruption is, is a, is a major driving factor for organizations. And that also is complex and is a challenge because s a p systems today are more important than ever. Um, with the Global Pandemic followed by the supply chain crisis and the current world economic situation, it’s important to have, super important to have real-time insight into your business around the clock. Um, and that makes plan downtime more difficult to schedule and increases the importance of modernizing your systems without disrupting the flow of your business along the way. And, you know, this is one of, I think, the main goals today that s a P knows organizations face and it’s positioning Rise with s a p is a means for their meeting that challenge. Um, and that’s, that’s the goal that they hope organizations will achieve through their vision for cloud E R P, but also with the capabilities that that SAP P sra HANA Cloud offers in terms of what we sort of see the actions organization, organizations are taking in response, um, you know, creating a unified landscape that provides better movement of data.

(41:48):

And I think that sort of correlates with the types of platforms in which organizations are most likely to invest. Um, according to the research we, we did recently on how business leaders are scaling platforms in innovation. Um, and in that research we saw analytics integration and data with three of the top five platforms that organizations were most likely to be investing in. Uh, and I think that need for an analytics innovation and data is very much part of what s A P offers through rise with s a P, either through the capabilities that are part of s sap, p s for HA cloud already, or through the business technology platform, which offers s SAP P Analytics Cloud, S A P Integration Suite, and S A P Hana. Um, you know, the second strategy they’re following here is that, you know, that aligns closely with the topic of updated systems and processes, uh, is that of implementing transformed and standardized end-to-end processes for core E R P users.

(42:46):

You know, one of SAP’s key goals for Ryans s a p as part of that move to creating an intelligent, sustainable enterprises, creating a clean core. Um, obviously if you do a new implementation, that’s somewhat easier because you’re starting from scratch. But if you have that clean core, um, and eliminate unnecessary customizations and focus instead on extensions, uh, that do not prevent updates, that can be a key goal for many organizations that are pursuing newer or greenfield deployments. And it does make it much easier for organizations to use technology such as automation and machine learning, if you have that clean core. And then lastly, lowering cost and increasing flexibility are the biggest drivers for organizations currently pursuing infrastructure change. We saw that in our Infras S A P Infrastructure and Landscape Trends report, because all organizations wanna reduce the cost of their infrastructure, but at the same time, they need additional flexibility, particularly at times such as month end, quarter end, year end, um, some sort of period close.

(43:53):

Now organizations are looking at the cloud to provide that landscape, and that’s another one of SAP’s core tenants rise with sap. Um, you know, it’s your journey to the cloud. The way SAP describes it is that they meet you at the point you are and help you get to the cloud. Um, other organizations are looking at the centrality of cloud deployment in the solution as a way of jumpstarting their SAP workloads from their existing landscapes into a more scalable and flexible environment. Um, some recommendations here, um, you know, it’s critical when you’re starting, when you’re looking at Rise with sap, when you’re looking at E R P Cloud E R p, when you’re looking at innovation, your business teams have to be involved in the transformation process of systems, transformation of systems and processes. Although tools like S sap psig, navo can help guide business process transformation, business teams have to be included in the changes to both systems and processes if they’re going to be successful, not including your business teams from the start means that changes may not meet the needs of business teams, and that poses a risk of transfer, transform systems not being adopted.

(45:10):

Um, achieving modernization without disruption involves combining the right technologies with experience. Uh, SAP organizations can’t afford to have systems unavailable for an extended period, right? You know, that you can’t have, you wanna limit downtime, excuse me, but moving to a new E R P system and building a platform for innovation isn’t necessarily straightforward. You have to select the right technologies and combine them with an experienced implementation team to ensure that they are able to effectively achieve your goal of modernization without disruption. Um, and standardization can help provide the platform you need for future innovation. And one of the major strategies being implemented by respondents is implementing transformed and end standardized end-to-end processes for core E R P users. While it’s possible to perform a system conversion that takes your existing environment into SAP S for a HANA with as few changes possible that can result in future challenges with process transformation.

(46:13):

If organizations want to build a platform for innovation, it’s important to have an environment in place that provides for future needs, such as machine learning, artificial intelligence changed governmental requirements. The most effective way to do that is to standardize processes across your systems as you move looking at some of the requirements, uh, that organizations outlined. Um, and I think what I’ll do is I’ll sort of jump here. Um, I mean, this is really connected to creating a platform for innovation. Um, it’s about resilience, right? Comprehensive monitoring to ensure system health and security. Uh, it’s about having a partner with experience migrating and managing transactional historical data with a number of s a P organizations that have been running their E R P systems for 10, 15, 20 years. You need someone who’s experienced in migrating and managing the data from those systems if you’re going to be able to successfully create a new platform for innovation in a new e r P system.

(47:24):

And that’s, that’s really what S A P S rahan is. It’s a new e r P system. Um, and, you know, one of the potentially hidden costs of a move to S A P SRA hana, uh, or, or rise with s a p is what do you do with all that data that you’re not necessarily bringing into S A P SRA hana? Do you put it in a data lake? Uh, do you maintain your E C C system, you know, in parallel for a number of years, uh, so that, you know, if GDPR requests come up, you can potentially, you know, for up to five years go back and delete data or delete, um, you know, uh, information about the people who are requesting that to be removed. You want to have access to that historical data somehow, somewhere. The question is, what do you do with it?

(48:19):

Um, you know, because many organizations are limiting the amount of data they’re bringing into S A P S for hana, simply because the HANA licenses based on the size of your, the size of your database. Um, you know, so the more data you store in there, the more expensive your license, um, the ability to use implementation partners and the service provider of their choice. Obviously, that’s something that S A P is pushing for. Rise with s a p, um, you know, you choose your service provider, you choose your implementation partner, uh, it’s an s a p contract. Um, you’re definitely ensuring that the data is, uh, that you’re, uh, you’re, you’re working with s a P through all these things, but you choose your hosting partner, you choose your, uh, implementation partner. Um, you know, also, or a good and important requirement for organizations is a proven partner with experience implementing cloud E R P.

(49:20):

Uh, this is super important because, um, you know, you want someone who’s going to be able to implement your E R P in the cloud. You don’t want someone who doesn’t have that level of experience. I mean, many organizations that I’ve spoken with are working with multiple partners as part of their rise as, as part of their move to rise with s a p, they might have a local implementation partner that they work with, um, on a regular basis. They may engage a specific partner to help with, um, data migration, uh, to help with other specific needs as part of the broader project. Um, some are working with their, uh, you know, a global solution service provider. That’s, you know, that’s what some of the implementation partner that s asset partners that s SAP P allows you to choose. But others are moving to some that have a more specialized knowledge with implementing cloud-based e r P systems. Um, and lastly, the requirement that organizations have is the ability to have insight into process performance. And this is where S A P is really sort of positioning. Um, s a psig navo, uh, you know, that’s something that, um, you know, uh, gives you insight into the way your processes are being used into the way they’re being performed. Um, you know, conversations I’ve had with people, uh, over the last several years have suggested that, excuse me,

(50:53):

For many SAP systems, there’s many, there’s a lot of customizations in place and organizations aren’t even necessarily aware of which ones are still actively in use. Um, you know, this is where having insight into what processes are being used and the performance of those processes can be extremely valuable if you’re looking to update them to get to a, you know, what do you have to bring forward into S A P S for Hannah? What is it that you can eliminate, um, which are the processes that are potentially causing slowdowns? Um, you know, it’s all critical to, uh, to the move to, um, to a cloud e r P system and, and providing a platform for innovation in general. So looking at the technologies, uh, that organizations and, and we sort of group technologies into three or four different real areas. The first is those that are currently in use with organizations, the second, uh, technologies that they’re implementing.

(51:56):

Um, the third is technologies that they’re evaluating. And, uh, the last grouping is technologies that they have. Uh, they’re, they have no plans for. Um, so, you know, when we, we provide a list of technologies, so those completing the survey, and it sort of allows organizations to select between those four, those four different categories, uh, for these different technologies. As you can see for cloud E R P, for, uh, building a platform for innovation, the technology most in use today is, is H A N D I. Uh, not really surprisingly, you people want resilient systems, uh, managed infrastructure on premise. Now, that could be a number of different things. There are people that have outsourced their it, um, but there are also, um, offerings available from, you know, three of SAP’s longtime partners, uh, HPE GreenLake, uh, Lenovo True Scale and Dell Apex, um, which give you a managed environment in your data center that is available as a operational, uh, expenditure model.

(53:02):

Very similar to the cloud. You don’t own the hardware, you simply lease the hardware. It has flexibility, it has scalability. Uh, and I think this is a, potentially a combination of those things, probably more the outsourced it, uh, at least for the, for, for those currently in use. Um, cloud-based platforms and infrastructure, you know, despite fact that people have been mu moving workloads to the cloud for many years, um, still not there yet for everyone. Um, software is a service environment, um, maybe not for your e R P system yet, but that might be a pos potential might be a possibility in the future. Pairing that with tools that people are, or technologies that people are implementing, uh, you know, having an e r P system at the cloud is something that over 40% of respondents say that they were planning on implementing over the next two years.

(53:56):

Now, that could be as simple as a lift and shift of an existing E C C environment, for example, to, uh, infrastructure as a service. It could be, uh, or it could be something adopting sa something like s A P S for HANA Cloud. Uh, obviously software is service deployments are getting, seeing a lot of people implementing custom code lifecycle management. Something very important if you’re planning, uh, on updating systems. Um, cloud-based platforms and infrastructure, uh, business process transformation tools. These are many things that we did not see on the previous slide, uh, as, as sort of being a focus for what people are implementing over the next couple of years, and then the technologies that they’re evaluating. Business process transformation tools, data cleansing tools, tune to managed infrastructure. Now, if we look at the recommendations that I put together here, they’re really more about hyperscalers than, um, you know, what I just talked about.

(54:55):

So starting with explore how hyperscalers can enhance your plans for innovation. If you’re planning to innovate, um, you want to have a, when you select a cloud service provider, you want performance and ease of ease of migration, right? You also want to be able to access innovative services. Now, rise with s SAP is more than just the SAP p s for HANA product, right? It’s a set of technologies that enables process transformation, migration tools, infrastructure, and credits for S A P P T P, right? So each of your cloud service providers has capabilities that can complement and enhance that. Um, selecting a cloud service provider for Rise with SAP is more than just picking a name. Um, many organizations have existing relationships with cloud service providers, and they might think that selecting the cloud service provider for their rise with s a P implementation is as simple as choosing who they already know, but much more is involved.

(55:52):

Um, various providers can offer different prices depending on when the bill of materials is submitted to them by S A P, but it’s also more important to understand whether the provider supports the capabilities beyond SAPs for ahan Cloud that you require, make sure your provider providing whoever you choose, can support your needs with RI for Rise with s a p, um, and then rise with sap. Obviously, as I’ve already talked about, supports more than just a greenfield deployment. If you’re choosing S A P S for Hunter Cloud private edition sort of general recommendations, um, you know, we’ve seen people who are more likely, who are using Hyperscalers, um, for their s a workloads are more likely to be considering a move to Ryan with s a p. So use your existing engagement with them as a starting point to choose a cloud service provider for Ryans.

(56:46):

With s a p, um, 86% of respondents are using public cloud providers or hyperscalers in some manner, although only 51% of respondents are using them for s a P workloads. Um, use the experience you have with building these relationships and working with hyperscalers as a starting point. You know, might start with cost, ease of migration, access to additional services, uh, et cetera. Um, but help that, use that to guide your right decision. Um, understand the rise with SAP is an option no matter the size, right? Although smaller organizations are more likely to be considering a move to rise with s A P and larger organizations primarily are saying they didn’t know whether they were considering it. Um, you know, it’s still a possibility given the various deployment options, uh, available for SAP s for Han Cloud Public Edition, and S A P S for ahan Cloud Private edition.

(57:46):

The same deployment options are available as on-premise release. It means no matter the size of your organization, rise with s SAP can be an option for you. It just has to fit what you need, um, but ensure you have a strong internal team to support your project. Most SAP customers already have strong internal teams they’ve built over the years. And while it might seem as though rise with s a p is largely handled by an implementation partner, um, you know, customers we have spoken with found that a strong internal team has been critical for their success. Um, and ensuring that team is prepared and ready is more likely to make your RISE project successful. And lastly, verify the availability of your implementation partner. And it’s, and their experience with Rise with s a p. Many partners and system integrators, uh, will have limited availability over the coming years due to the demand for their services in moving to SAP p s for HANA in general, and rise with Aspecific specifically.

(58:45):

But even if you have an implementation partner that is available, make sure they have experience with the kind of rise with s a p implementation you want to complete. All right. Um, unfortunately that is all the time we have for today. Um, if you do have any questions, please feel free to reach out. Uh, if there’s, I, I don’t think there’s anything in the q and a box right now, but we’d be more than happy to answer any questions you might have. I do thank you for attending today’s webinar. Uh, shortly after the live event, you’ll receive an email, um, with the presentation and so that you can access the, the webinar on demand. Uh, so on behalf of sap Insider, and aws thank you for your time and have a great day.

In this on-demand webinar:

Organizations are under pressure to innovate. Legacy systems need to be updated or replaced with solutions that meet today’s needs and offer improved processes and features. New systems must be agile and provide a platform to support future innovation. SAP is positioning RISE with SAP as the solution to address these needs by introducing new business models, improving efficiency in existing processes, and modernizing mission-critical systems—all without disruption.

But while SAP is emphasizing RISE with SAP as the key part of their cloud ERP strategy, many organizations still only have limited familiarity with the solution. But for those that have knowledge, the most important capabilities are those for innovation followed by simplified management and operations as seen in Figure 1. But even though organizations are looking at the capabilities for innovation, those who are using hyperscalers for SAP workloads are much more likely to be considering a move to RISE with SAP (53%) than those who are not (22%).

Figure 1: Factors impacting a RISE with SAP decision

Tune into this on-demand webinar to explore the full data analysis from 152 members of the SAPinsider community and receive recommendations for your own plans.

- Learn about what is important for organizations around innovation

- Explore the role hyperscalers are playing in RISE with SAP

- Understand what types of organizations are looking at RISE with SAP

- See what you need to do to be ready for RISE with SAP

Sponsors: