Position Your Business to React and Adapt to Any New Regulations with Ease

In the increasingly complex and regulated business landscape, compliance is a top concern for companies of every size, in every industry. Analytics are becoming critical to successfully unify internal processes and data to meet compliance standards. Bramasol Inc., in Santa Clara, California, is a leading provider of SAP solutions for the digital enterprise based on SAP S/4HANA. It focuses on areas around finance digital transformation and accounting regulatory compliance. Companies worldwide rely on the expertise and experience of Bramasol to help them comply with and benefit from the vast array of compliance requirements.

In the past few years, major standards have appeared in two finance and accounting compliance areas that cut across industries. First, ASC 606 and IFRS 15* are the US and international standards for revenue recognition. They provide new guidance on one of the most important measures used by investors in assessing a company’s performance and prospects. Second, ASC 842 and IFRS 16 present dramatic changes to the balance sheets for lessee accounting. These standards require companies to recognize leased assets and lease liabilities on the balance sheet and disclose key information about leasing arrangements.

SAP has been a key player in supporting the new standards. The lease accounting standard is incorporated in a sub-module called the SAP Contract and Lease Management application. New software has been added to SAP’s finance stack called the SAP Revenue Accounting and Reporting application to support revenue accounting.

SAPinsider recently interviewed Dave Fellers, CEO of Bramasol, and John Froelich, the company’s Vice President of Marketing and Strategy, to explore the key trends in compliance, as well as to find out how companies can turn compliance into a competitive advantage.

(* Developed by the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB), Accounting Standards Codification (ASC) 606 and International Financial Reporting Standard (IFRS) 15 are the new revenue recognition standards that affect all businesses that enter into contracts with customers to transfer goods or services — public, private, and nonprofit entities.)

Q: How does Bramasol help SAP customers in the area of finance and accounting compliance?

Dave Fellers (DF): Bramasol has been helping companies with transformations for nearly 25 years. We support a range of companies that may be moving from QuickBooks-type environments to full-fledged ERP systems, or transforming their finance via the power, flexibility, and scalability that is provided through SAP S/4HANA private cloud. Bramasol’s focus is to be very detailed and focused in the areas that we serve. We bring the most senior people in the industry into the work that we do, and we charge a reasonable price for that. We are not just helping companies meet a specific project need — we are helping them along the journey they are taking.

Dave Fellers (DF): Bramasol has been helping companies with transformations for nearly 25 years. We support a range of companies that may be moving from QuickBooks-type environments to full-fledged ERP systems, or transforming their finance via the power, flexibility, and scalability that is provided through SAP S/4HANA private cloud. Bramasol’s focus is to be very detailed and focused in the areas that we serve. We bring the most senior people in the industry into the work that we do, and we charge a reasonable price for that. We are not just helping companies meet a specific project need — we are helping them along the journey they are taking.

Regarding finance and accounting compliance, people typically think about compliance as special regulations — such as ASC 606, ASC 842, IFRS 9, the Sarbanes-Oxley (SOX) Act, or the Foreign Corrupt Practices Act (FCPA) — that affect only big businesses. However, compliance is not just for large companies, and it comes in many different forms, such as compliance and standardization around Generally Accepted Accounting Principles (GAAP) for your accounting, Securities and Exchange Commission (SEC) rules, or similar regulations. Smaller companies must demonstrate they are compliant and have appropriate accounting and other business regulatory processes for any number of reasons. They might be looking to go public, or they may want to be acquired by a larger organization. So smaller companies are interested in leveraging SAP’s capabilities to meet compliance, and we support them. Compliance is for everyone.

Q: Can you explain the Comply, Optimize, Transform process?

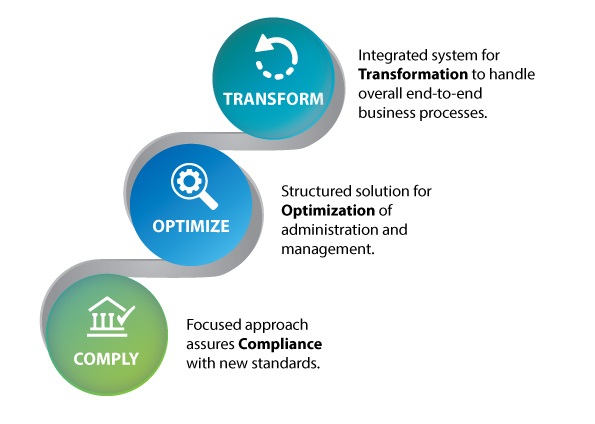

John Froelich (JF): Comply, Optimize, Transform is an adaptive framework that Bramasol uses to help our customers define and execute a successful digital transformation — whether it is a business transformation or a finance transformation — in a flexible manner. Comply, Optimize, Transform refers to the three phases of the framework (shown in the figure below).

John Froelich (JF): Comply, Optimize, Transform is an adaptive framework that Bramasol uses to help our customers define and execute a successful digital transformation — whether it is a business transformation or a finance transformation — in a flexible manner. Comply, Optimize, Transform refers to the three phases of the framework (shown in the figure below).

Figure 1 The Comply, Optimize, Transform framework helps customers define and execute their digital transformation

Comply: Build a roadmap that provides a firm foundation for today. At this stage, we create a firm foundation for transactional excellence. This ensures that the accounting meets the appropriate standards and that required journal entries are made accurately and completely. We clearly define roles and responsibilities, and we create a data foundation with clean data and processes that companies can build upon.

Optimize: Refine processes for tomorrow. This is a flexible stage in which processes are tuned or optimized to help drive efficiency, lower costs, and provide additional insights to drive competitive advantage. In this stage, tools such as robotic process automation (RPA), machine learning, and artificial intelligence can be applied to help simplify and automate key repetitive activities, freeing users and management to interpret and act on the insights provided. Let me explain how this applies to revenue accounting. Many of our customers have complied with the revenue accounting rules, such as ASC 606, using spreadsheets and database tools that are adequate but also cumbersome. These companies can automate and simplify the process using the SAP Revenue Accounting and Reporting application. However, some companies that use this application may have implemented manual workarounds, or they may have multiple solutions for areas such as commissions accounting. Through a holistic approach that integrates and leverages the power of SAP Revenue Accounting and Reporting, they can reduce the time it takes to calculate the effect of commissions — while automating the process, improving security, and driving better accuracy. That is why flexibility is critical, because every company is coming from a different starting point, with different philosophies and different challenges.

Transform: Create a plan for the future. The goal is not to define the end state of a digital transformation or finance transformation journey, but to create a vision of where a business wants to go. That vision enables the organization to implement new business models, such as a subscription-based or outcome-based model, to adapt to and take advantage of the new economy. Then they can apply advanced tools toward that model, such as SAP Revenue Accounting and Reporting, SAP Billing and Revenue Innovation Management (formerly SAP Hybris Billing), and the SAP S/4HANA Finance solution for advanced payment management.

Q: At what stage of that journey do you see the majority of companies right now?

DF: In today’s world, most attentive companies recognize that regulations and compliance rules are coming from all sorts of angles. They have geared themselves internally to address and handle these kinds of changes, and they have created organizations that anticipate and monitor these changes. They have also implemented internal functions to implement the changes, allowing them to be nimble and proactive so they leverage the standards to their advantage.

Leading companies work closely with their audit function that interacts with industry groups, looking to influence the ways in which the rules are rolled out or interpreted. On the other extreme, reactive companies are using spreadsheets or, worse, manual and paper processes to address the regulatory requirements. However, if you comply in that manner, your compliance journey isn’t done. You don’t meet the other SOX requirements around the ability to produce reliable, repeatable processes that demonstrate that your accounting is consistent and reliable.

We still see a lot of companies out there that have not yet completed that first step of our Comply, Optimize, Transform framework in an adequate way. Optimization alone is just doing a better job of leveraging some sort of tool to systemize your compliance. That’s important to do, but it can’t be the end point if you want to make compliance a competitive advantage.

Q: What enabling technologies and intelligent technologies come into play for the Optimize phase?

DF: Optimization is really the automation of business processes. This requires the right integration capabilities, such as leveraging SAP Cloud Platform and application programming interfaces (APIs) or technologies around RPA and machine learning.

JF: On the treasury side, customers are using SAP Cash Management to gain better visibility into their current cash position. One company uses the concept of in-house cash — where it brings all the cash into a single place and manages it through an SAP solution. The company has saved hundreds of thousands of dollars annually on managing and dealing with its cash, such as by reducing the interest rates it pays from pooling the cash together. This also creates a more flexible and resilient finance ecosystem so the business can react quickly to the changes in the marketplace.

Q: How do you empower companies to gain that greater visibility?

DF: Our philosophy is to take the basic solutions an extra step. We support processes around revenue recognition, lease accounting, and treasury. Often this starts from a compliance angle. But then we enhance these tools to give companies unique visibility through analytics — using SAP Analytics Cloud and SAP Digital Boardroom, for example.

As finance and compliance become more complex, visibility is critical. For example, lease accounting for lessors brings up compliance issues related to revenue recognition. Companies that lease products to others need to be able to depreciate or amortize the value of those assets over the useful life of the asset. This value is inextricably linked to how they will do their revenue recognition, and more specifically, how they calculate a key part of the five-step model — standalone selling price. Like many areas, what seems simple on its face is really more complicated. In the world of revenue recognition, one of the key features we are adding is the ability to handle commissions, which are a major cost and issue for sales organizations. It can be challenging to tie commissions to the revenue per the regulation, so it’s an area we have focused on to provide a comprehensive solution.

JF: A lot of companies are doing consumables or tying contracts together. This is something we are seeing more and more, which is particularly appropriate given where we are today with COVID-19. Think of the old shaving models, where companies made money on the blades rather than the razors. That same model is evolving for medical devices, printers, and even oil and gas. We are helping enable that model for customers through the revenue accounting solution and other tools.

Q: Can you provide an overview of the Bramasol “health check” offering?

JF: This relates to the state of mind of the different businesses we work with. While some companies view compliance as a nuisance, the most successful organizations see it as an opportunity to improve their business and focus it to transform. Our health check tool enables companies to examine their revenue accounting, lease accounting, or treasury from an ecosystem perspective. Revenue accounting really sits in a broader order-to-cash ecosystem — everything from creating the order to invoicing to recognizing the revenue. Leasing resides in a broader section of the procure-to-pay process. Treasury has a myriad of different spaces that it sits in, such as cash management, debt and investments, and financial risk management. The health check allows companies to pinpoint where they can improve their processes and drive new ROI. For example, we worked with a software company in Virginia called Ellucian, which provides ERP systems for schools. Using SAP Revenue Accounting and Reporting, this company not only accelerated the close but identified specific opportunities to upsell and cross-sell to its customer base. That’s the impact of changing the viewpoint from “I simply comply” to “I use these tools to get better.”

Q: How does SAP S/4HANA fit into the picture and the new subscription-based/service-based models?

DF: Transformation is not a final destination, but an ongoing process that requires the ability to handle massive amounts of data. SAP S/4HANA is a foundation for making this possible. For example, another one of our customers — the Certified Collectibles Group (CCG) in Sarasota, Florida — wanted to gain greater visibility of their customers, better understand its costs, and develop improved processes. SAP S/4HANA brings the necessary data together and puts the information in a state where it can be analyzed and easily viewed on dashboards. That provides the nimbleness and ability that will be critical for anyone going forward.

JF: “Something as a service” is being embraced in so many places. Our customer Hewlett Packard Enterprise, for instance, had shifted from a “buy a piece of equipment” model to a subscription model in which customers rent or use space based on the amount of processing they do. In a subscription model, you want to react to your customers quickly and provide different abilities to modify or manage their billing plans. The SAP Billing and Revenue Innovation Management application allows businesses to do that. However, it’s the power of SAP S/4HANA that permits them to perform collections and credit management, for example, by integrating information from different solutions. The convergence of all these technologies drives these new economic models through an ability to react quickly, while being able to scale.

Q: In these uncertain times, why is it important for companies to act now?

DF: There are always factors — in industry, in business, in the environment, and within government — that drive the need to respond and react. It could be new regulations or a pandemic like COVID-19. You don’t necessarily know what will be the next event you have to react to, so you must position your company to be able to adapt and react to anything. In today’s environment, some companies are under a huge threat to the very existence of their business, and other companies have a huge opportunity. However, even those companies with opportunity are not all doing equally well. Thinking about that data transformation hierarchy and having a product like SAP S/4HANA to support the business should be a priority so that is not an issue when you are worrying about the survival of your company.

JF: Many companies today are trying to save money; others are determining how they can thrive for the future, while maintaining a resilient supply chain and finance infrastructure. They are really taking this as a chance to step back and transform their business. While COVID-19 and the current times of economic disruption are certainly challenging, they do present an opportunity for those who want to step up. My advice to these companies is this: don’t be reactive. Prepare now by creating a plan and a vision for transformation — leveraging a framework like Comply, Optimize, Transform. Establish some key goals for the near term that are flexible enough to allow you to react quickly to the inevitable changes. If you don’t act now, somebody else will, and that could have huge implications for the slower companies they leave in their wake.