Meet the Experts

Key Takeaways

-

Plan for RISE with SAP to be the default model for moving to SAP S/4HANA

-

Learn about RISE with SAP before a decision needs to be made on whether to use it

-

Understand the security requirements for RISE with SAP and whether or not SAP is responsible

Click here to download the Benchmark Report

Click here to download the Benchmark Report

Click here to download the Detailed Findings Report

Click here to download the Detailed Findings Report

In this report:

The tax compliance landscape is changing rapidly due to technological advancements, regulatory changes, and a greater need for transparency. Traditional manual processes are becoming insufficient, pushing organizations to adapt their finance and tax functions to a digital environment. This trend coincides with the increasing adoption of SAP S/4HANA, which offers real-time capabilities and improved efficiency for finance processes. This report examines how these global trends reshape tax functions within the SAP ecosystem and emphasizes the importance of integrating tax technology solutions to drive innovation and automation in tax operations. Integrating SAP S/4HANA with advanced sales tax solutions, global tax engines, and e-filing and e-documentation systems further enhances its capability to streamline complex tax operations across different jurisdictions. To maximize the value of these investments, global organizations’ finance and tax leaders must incorporate tax strategy into their enterprise’s transformation, supported by SAP S/4HANA, to steer tax technology innovation and automation initiatives effectively.

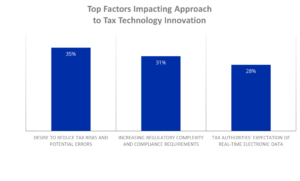

SAPinsider surveyed between October and December 2023, involving 138 SAP finance and tax community members, to gain insights into strategic priorities and considerations regarding tax technology innovation and automation. The study reveals many respondent organizations face challenges in their tax technology landscapes, negatively impacting current business operations. These challenges represent key factors driving priorities for tax technology innovation among SAP customers. A primary driver is the desire to reduce tax risks and potential errors (34% of respondents), followed by increasing regulatory complexity and compliance risks (31%) and the need for electronic data interchange with tax authorities (28%) (see figure below). These factors indicate a need for organizations to invest in robust solutions that facilitate tax technology innovation and automation. Yet, half of the organizations surveyed are not adequately prepared to future-proof their tax functions, a critical concern given that nearly 60% of respondents plan to incorporate machine learning and generative AI into their tax compliance processes.

Explore related questions

Complete the form below to access the full benchmark report with industry peers’ insights, strategies, and best practices.

- Learn about critical drivers influencing tax technology innovation priorities, including reducing tax risks and adapting to regulatory complexities.

- Understand the importance of integrating tax strategy with enterprise transformation to enhance tax technology innovation and automation strategies.

- Gain insight into utilizing SAP S/4HANA Cloud and other SAP applications for efficient tax management and compliance.

- Discover strategies for automating and ensuring compliance in tax reporting, highlighting the importance of investment in tax technology solutions.